Online Trading for Beginners: A Step-by-Step Guide

Are you intrigued by the idea of trading online but don’t know where to start? With growing accessibility and an explosion of resources, online trading has become one of the most popular ways to grow wealth. However, navigating the world of online trading for the first time can feel overwhelming. This step-by-step guide will help beginners understand the foundational steps to kick-start their trading journey.

What is Online Trading?

Online trading involves buying and selling financial securities like stocks, bonds, forex, and commodities through an online platform. Gone are the days of calling traditional brokers; instead, everything can now be managed from the comfort of your home with just a few clicks.

This accessibility has democratized the financial market, allowing people to invest regardless of their experience. However, it’s imperative to enter the world of trading with knowledge and caution to minimize risks and maximize gains.

Step 1: Understand the Basics

Before you make your first trade, it’s important to build a strong foundation by learning the basics. Key concepts like stocks, mutual funds, forex, and indices should be clear. Additionally, understanding terms like market orders, limit orders, and stop-loss orders will be crucial for navigating the trading platform.

There are countless free resources like trading blogs, courses, and ebooks that introduce these fundamentals. Remember, jumping into trading with insufficient knowledge is a recipe for losses.

Step 2: Identify Your Trading Goals

Every successful trader has clear, defined goals. Are you trading short-term to achieve quick gains, or are you investing long-term for wealth accumulation? Your trading approach will depend on your financial objectives, risk tolerance, and the time you’re willing to invest in monitoring market trends.

Take time to create a plan that includes your budget, the types of assets you’ll focus on, and how much risk you’re willing to take.

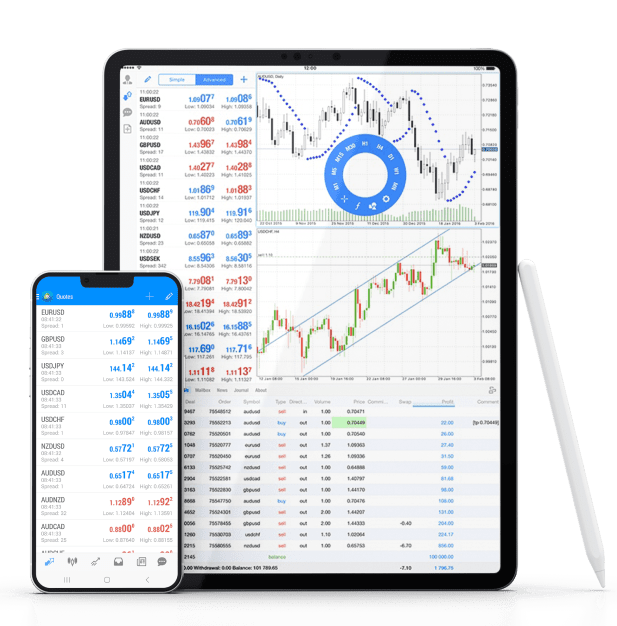

Step 3: Learn with a Demo Account

Most modern trading platforms offer the option to create demo accounts. These accounts allow you to trade with virtual money in a simulation of real market conditions. Practicing through a demo account helps you gain hands-on experience without financial risk.

Spend time experimenting with strategies, exploring the platform’s tools, and learning how your decisions impact outcomes. It’s an invaluable step to build confidence.

Step 4: Start Small and Gradually Scale Up

When you’re finally ready to begin live trading, start with a small sum of money. Use the knowledge and strategies developed during your training phase. Beginners should avoid risking large sums early because it takes time to understand market patterns and gain practical expertise.

Gradually increase your investments as you grow more comfortable with the dynamic nature of the financial markets.

Step 5: Stay Current with Market Trends

The world of finance is constantly evolving, and staying informed is key to successful trading. Follow financial news, read expert opinions, and monitor industry statistics to identify trends and anticipate market shifts. Many traders also rely on technical and fundamental analysis to make data-driven decisions.

Charting Your Trading Journey

Getting started with online trading may seem intimidating, but with the right approach, it can be an exciting and rewarding endeavor. By educating yourself, setting clear goals, and starting small, you can gradually ease into the process. Take the time to practice and always stay informed – success in trading is as much about discipline as it is about knowledge.